$79

Plus membership

3 Credits

All courses include:

eTextbooks

2 to 3-day turnaround for grading

Multiple chances to improve your grade

On-demand tutoring & writing center

Student support 7 days a week

$79

Plus membership

3 Credits

All courses include:

eTextbooks

2 to 3-day turnaround for grading

Multiple chances to improve your grade

On-demand tutoring & writing center

Student support 7 days a week

Managerial Accounting

$79

Plus membership

3 Credits

About This Course

ACE Approved 2023

The Managerial Accounting online course focuses on the identification, gathering, and interpretation of information for planning, controlling, and evaluating the performance of a business.

What You'll Learn

Compare and contrast between managerial accounting and financial accounting and assess how managerial accounting affects various management functions.

Discuss ethical standards in an organization and assess their role in the field of managerial accounting.

Define cost and distinguish between product costs and period costs.

Analyze the fundamental manufacturing cost categories and diagram the flow of product costs in a manufacturing operation.

Describe job-order costing system and evaluate its suitability in manufacturing and nonmanufacturing firms.

Describe process costing and evaluate the suitability of process costing in manufacturing and nonmanufacturing firms.

Compare and contrast traditional volume-based costing system and activity-based costing system.

Interpret cost behavior patterns to estimate costs and assess the need for contribution approach to income statements.

Graph CVP relationships and compute the break-even point using the contribution-margin and equation approach.

Determine the criteria that decide the relevance of a cost or a benefit and explain the concepts of sunk costs, opportunity costs, and unit costs.

Describe the key decision areas in capital budgeting and explain the concept of time value of money.

Describe the elements of a budgeting framework and assess the need for a budgeting framework in an organization.

Describe the various ways to set performance standards and assess the role of performance standards in cost management.

Explain the role of responsibility accounting in achieving set goals and list the responsibility centers.

Describe the key decision areas in capital budgeting and explain the concept of time value of money.

Determine the criteria that are used in determining and making pricing decisions.

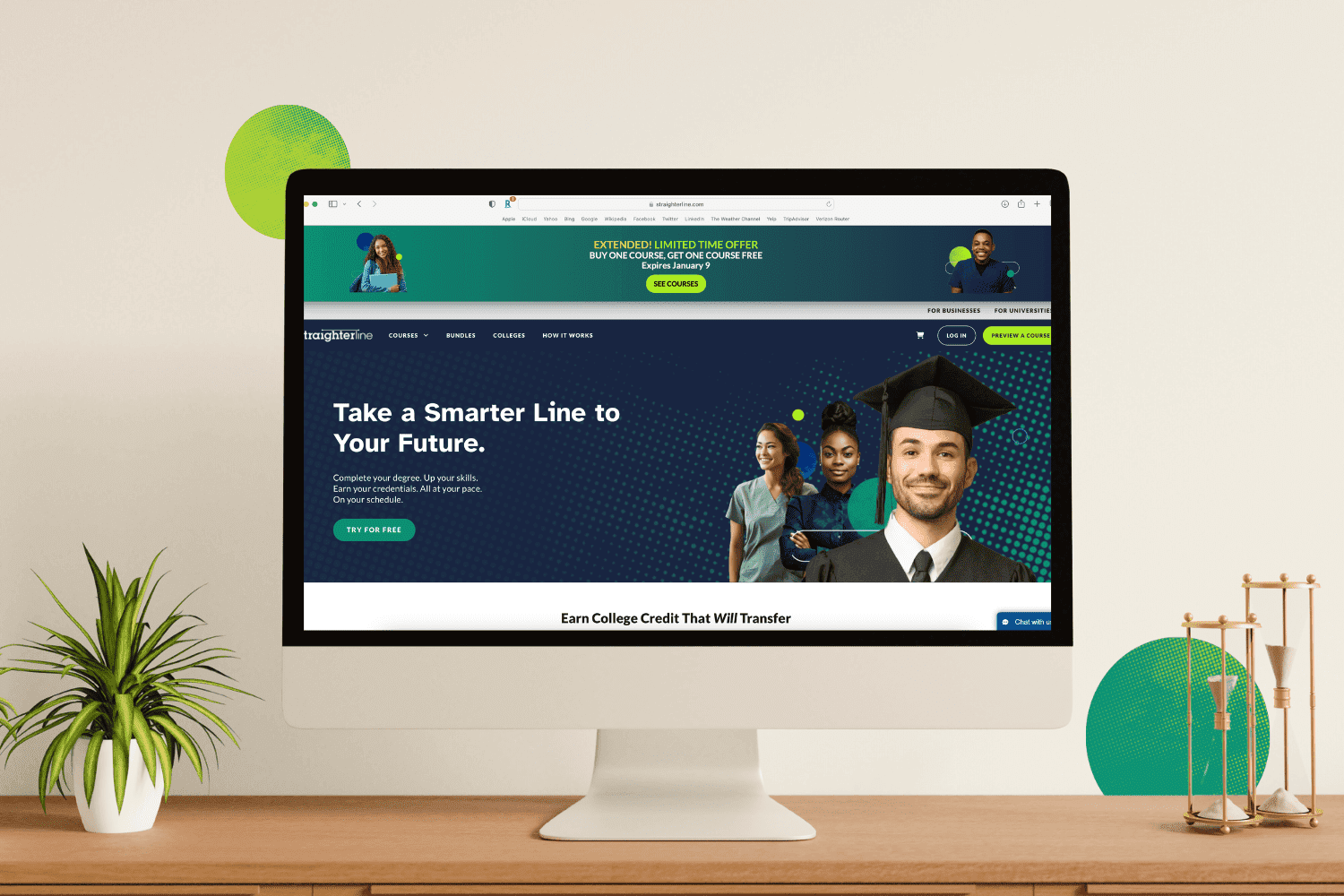

Your Life, Your Schedule, Your Education

Transfer into over 3000+ institutions that accept ACE courses or transfer directly into 180+ partner schools.

request information

Study concepts like the measurement of the costs of producing goods or services and learn how to analyze and control these costs. Our Managerial Accounting course also analyzes managerial accounting principles and systems through process and job order costing.

It is suggested, though not required, that students take Accounting I and Accounting II or its equivalent before enrolling in Managerial Accounting.

| Topic | Subtopics |

|---|---|

| Managerial Accounting and the Business Environment |

|

| Concepts of Cost Management Accounting for Custom Operations |

|

| Product Costing and Cost Accumulation in the Production Environment |

|

| Product and Hybrid Product Costing Systems |

|

| Activity Based Costing and Management |

|

| Analysis of Activity, Cost Behavior and Cost Estimation |

|

| Cost-VolumeProfit (CVP) Analysis |

|

| Absorption and Variable Costing |

|

| Profit Planning and ActivityBased Budgeting |

|

| Operational Performance Measures: Standard Costing and Balanced Scorecard |

|

| Flexible Budgeting: Managing Overhead and Support Activity Costs |

|

| Responsibility Accounting: Quality and Environmental Cost Control |

|

| Investment Centers and Transfer Pricing |

|

| Allocation of Support and Joint Costs |

|

| Decision Making: Relevant Costs and Benefits |

|

Your score provides a percentage score and letter grade for each course. A passing percentage is 70% or higher.

Assignments for this course include:

- 4 Graded Exams

- 1 Graded Midterm

- 1 Graded Final

The required eTextbook for this course is included with your course purchase at no additional cost.

Wild, John J., and Ken W. Shaw. Managerial Accounting. 8th ed., McGraw Hill Education, 2022.

Managerial Accounting students also take:

Helpful resources: