As you put the finishing touches on your tax return, you’re probably wondering which of your educational expenditures are tax-deductible. Can you deduct the cost of your new laptop, for example? And what about your textbooks or tuition? We scoured the Internet looking for the best source of quick answers to those questions. The best we found was the article What are Qualified Education Expenses? on the IRS website. You’ll want to check out this resource for yourself. But until you do, here’s a quick summary .

- There are basically two different ways to deduct college costs. The American Opportunity Credit lets you deduct tuition, student activities fees, and required textbooks. The Lifetime Learning Credit lets you deduct the same expenses, but only if you have to pay them directly to a college as a condition of enrollment.

- You can deduct the cost of a laptop that you need to complete your coursework. But if you’re using the Lifetime Learning Credit, you have to provide documentation that you purchased it from the college that you are attending, and that the college required it.

- What about textbooks? You can deduct their cost under either The American Opportunity Credit or the Lifetime Learning Credit deduction. But to use the Lifetime Learning Credit, you must have bought required books directly from your college.

- And room and board? Ouch! Room and board costs are not deductible under either program. Apparently the IRS figures that you have to eat and sleep somewhere, whether you’re a student or not.

But Check with Your Tax Preparer

We don’t mean to get all legalistic on you, but be sure to check out the advice in today’s post with your tax preparer before you deduct educational expenses on your taxes. Filing taxes can be complicated, and we don’t want you to make any mistakes.

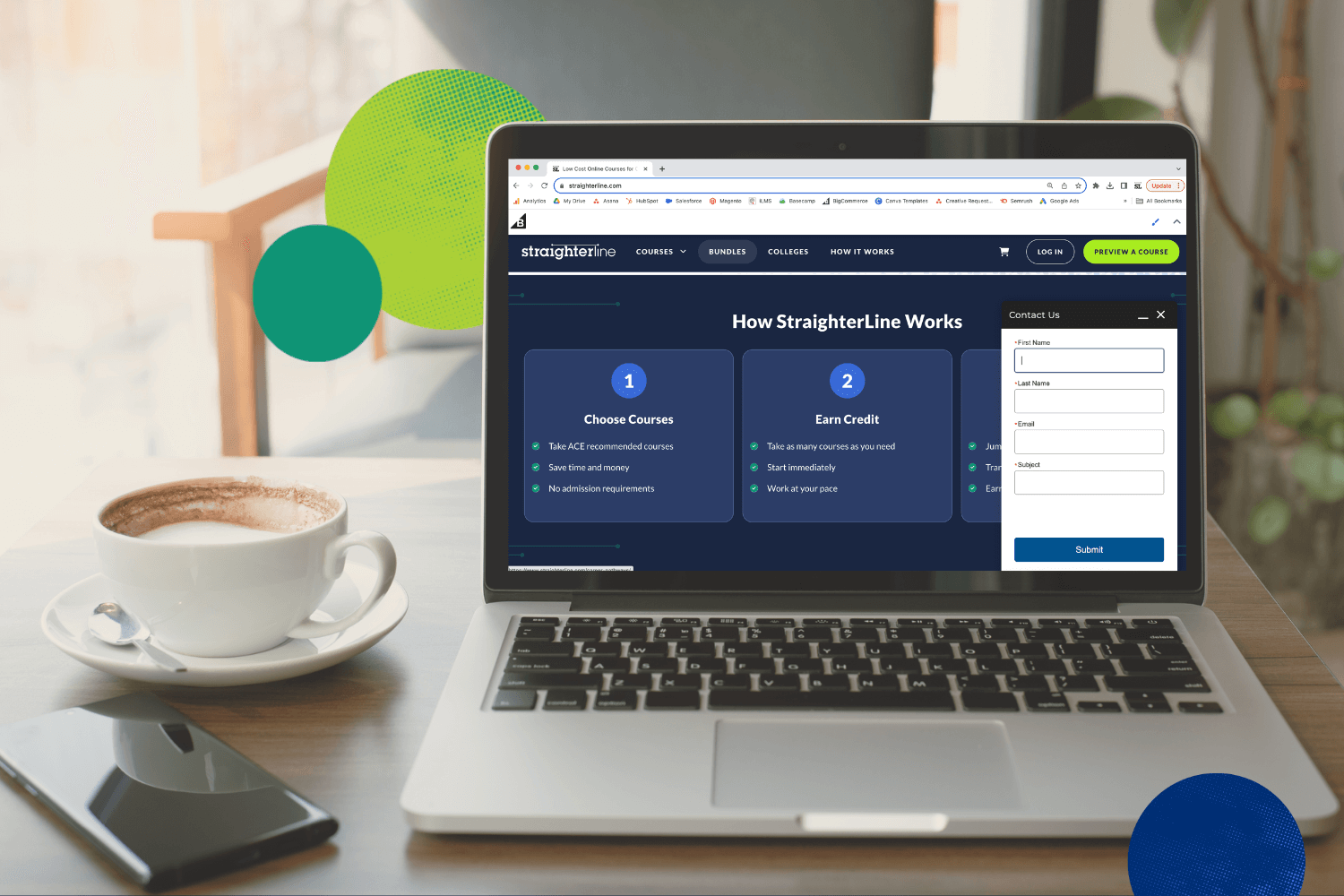

Lower Your Cost of College with Online Courses

StraighterLine offers convenient and flexible college courses. Complete your gen-ed courses online and make serious progress on your degree. At StraighterLine, we make it easy for you to save big on college courses.